Modern planning that creates value

The planning effort we offer is one of the most important initiatives you will undertake, because it will have a considerable and direct impact on your life and those of your loved ones. You can also have a positive impact on society today — and in the future.

Thanks to our professional financial and legal advice, you’ll gain the confidence and peace of mind that an exhaustive, carefully structured estate plan can provide.

Our Approach

1

Income Source Planning

Your financial plan will let you fully thrive throughout your life, with dignity and no financial cares.

2

Tax Planning

You can live in complete serenity, realizing your greatest personal, family and societal projects, thanks to efficient tax strategies.

3

Estate Planning

The wealth you have built will be transferred to your beneficiaries as simply and efficiently as possible, according to your wishes.

4

Philanthropic Plan and Social Engagement

Be able to make a difference, according to your values and the things you cherish. We will give you the means to have a positive impact and influence on your community, by incorporating charitable actions into your financial strategies.

Giving to others…in complete confidence

A philanthropic strategy is the next logical step after tax and estate planning. Many families have a strong desire to make a lasting contribution to causes that are important to them, but don’t know where to start.

Our seasoned and attentive team is there to support your thoughts about your philanthropic commitment. You can create wealth for yourself and loved ones, but also contribute to charities that correspond to your values.

We pride ourselves on giving you the means to contribute, as you wish. Small gestures and decisions today will make a great difference tomorrow.

“We wanted our life choices and investments to have a positive impact on our community.

At our most recent planning meeting, Rock suggested several philanthropic channels that we had never thought of. He was able to make everything very clear and accessible. We were able to have fruitful family discussions and make the choices that felt right to us!”

Nicolas and Flavie

Together for 15 years

Thinking of acquiring a second home in Costa Rica

Tax and legal optimization for entrepreneurs

Do you own a company? We understand that planning for tomorrow is becoming increasingly more complex. The most efficient ways to preserve your assets include reducing your current tax burden, limiting future income tax owed and optimizing the different benefits and credits you can receive.

Our tax planning exercise covers:

- Your Company

- Your Investments

- Your Assets and Real Estate

- Your Estate

In collaboration with our specialist partners, we offer an integrated approach that includes sound legal advice and the optimization of legal structures to manage your wealth.

Analysis and optimization of the tax efficiency of your assets

Optimization of your company’s administrative and legal structure

Creation and management of family trusts and asset protection trusts

Optimization of legal protection and review of the shareholder agreement

Planning of tax consequences in the event of death

Planned giving strategy

A gesture with impact.

An opportunity for your company.

Corporate social responsibility is becoming an increasingly important way for businesses to stand out. Given the labour shortage and increased competition, many companies understand the importance of creating a culture of philanthropy and sustainable development principles. Those at the cutting-edge of this movement are noticed for acting directly on employee loyalty and retention, and for the trust and engagement of their clients. They enjoy a competitive advantage in the market.

Don’t know where to start? Learn about the PPTA approach. You will understand how to implement your own strategy, based on your values and interests.

Tips

Tip #1

Have you thought of creating your own foundation?

Each year, you make personal donations, or via your company, without really knowing how your money is used.

Creating your own charitable fund may be an effective solution for you. Commonly called a philanthropic fund, it is a simple solution. You don’t have to be rich to create one!

This will allow you to better direct your donations, take advantage of interesting tax benefits and have an even more concrete impact.

Tip #2

Would you like to make a major donation after your death?

Using life insurance is an efficient way to do so. You can simply purchase a life insurance policy, and name the foundation or the charitable organization of your choice as its owner and beneficiary.

You will pay the premiums during your lifetime, and benefit from the tax credits. At the time of your death, the foundation or charity will receive the benefits of your gesture, while limiting the tax impacts for your loved ones.

Tip #3

Think about calculating your income taxes owed at death now

You’d like to transfer your wealth as completely as possible to your beneficiaries. Several strategies can be used to do this; some of them are more advantageous if they are created as soon as possible.

Don’t wait until you are retired to do this, especially if your assets include several real estate properties.

Tip #4

Get a tax and estate plan at no charge

Typically, a financial plan from an accountancy firm can take between 60 and 100 hours and may cost you more than $15,000!

With PPTA, you could benefit from such a report at no charge. Several financial institutions offer this service for free, in the hopes that you will purchase their financial products.

The idea is to have the professionals at a financial institution create an analysis for you and then work with your PPTA advisor to assess the resulting recommendations.

Think about it!

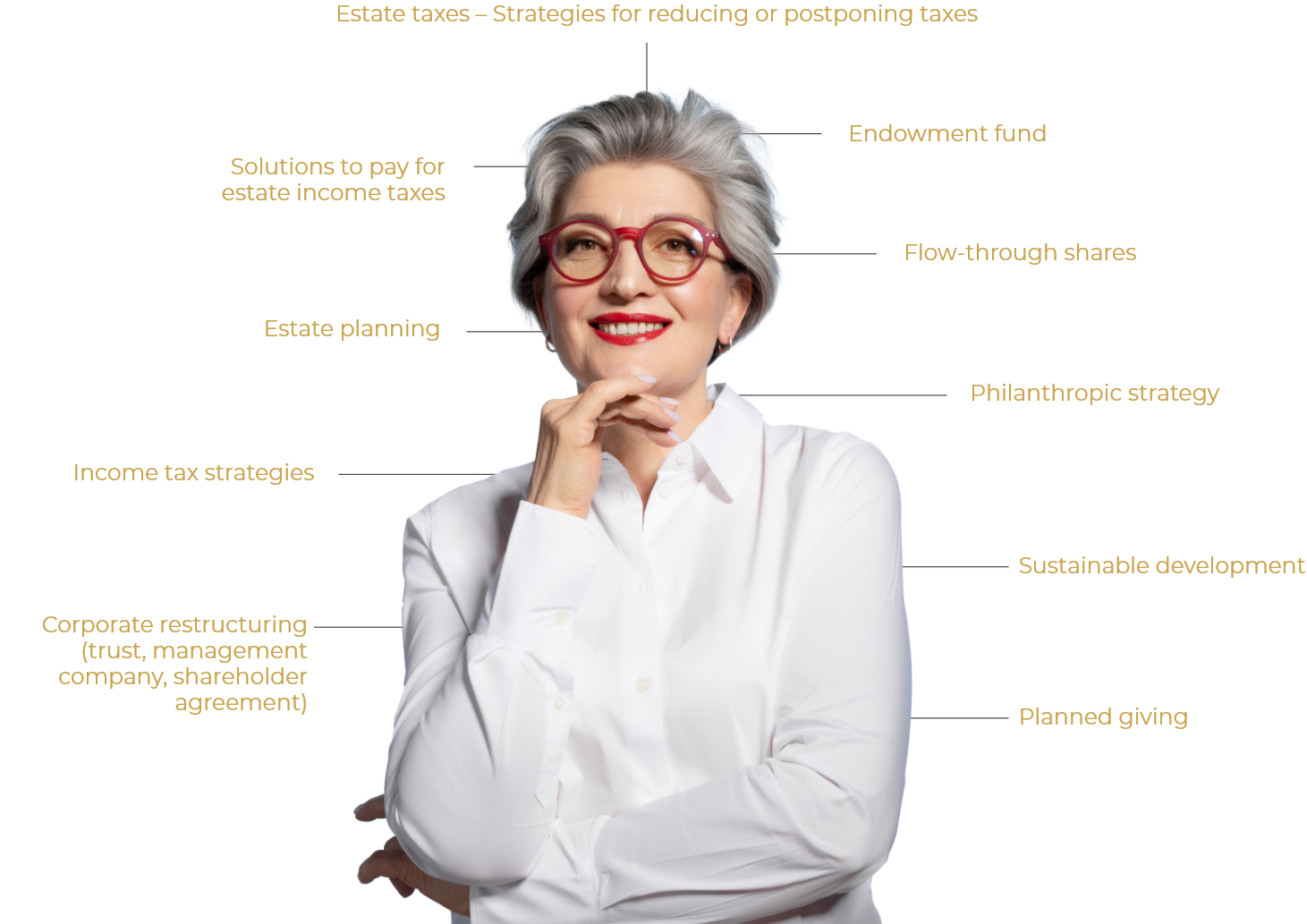

Our Products & Services

We offer a complete array of services to help you in this important process. If needed, we can refer you to a tax expert, a legal advisor, or a notary; trustworthy professionals with whom our team often collaborates.

Our Products & Services

We offer a complete array of services to help you in this important process. If needed, we can refer you to a tax expert, a legal advisor, or a notary; trustworthy professionals with whom our team often collaborates.

- Estate taxes – Strategies for reducing or postponing taxes

- Solutions to pay for estate income taxes

- Estate planning

- Income tax strategies

- Corporate restructuring (trust, management company, shareholder agreement)

- Endowment fund

- Flow-through shares

- Philanthropic strategy

- Sustainable development

- Planned giving

Tools at your fingertips.

Use our tools and calculators to evaluate a variety of aspects of your financial situation.

Discover the Team

Our clients have found peace of mind, a reliable team and solutions adapted to their situation.

Contact Us

Come meet our team. They can help you define your needs and hopes, and work with you to create the strategies to reach them.